FxPro - Trading Platform

Introduction to FxPro

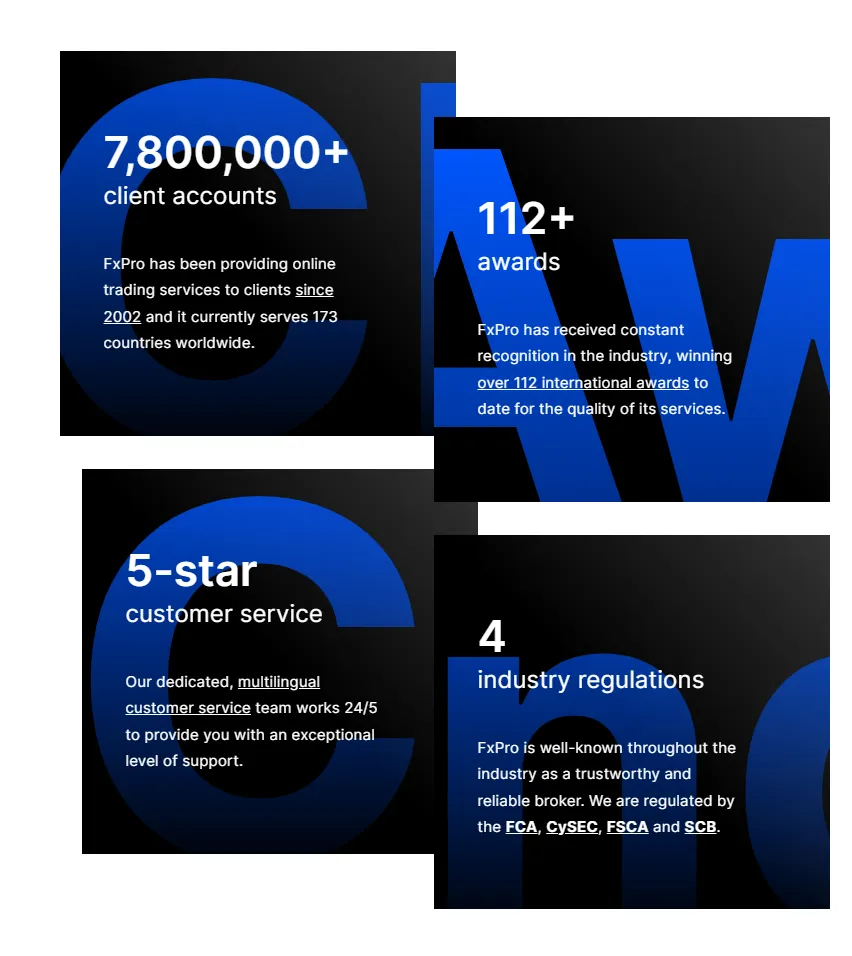

FxPro has established itself as a prominent forex broker since its foundation in 2006. Operating in over 173 countries, the company provides trading services through multiple regulatory frameworks, ensuring security and reliability for South African traders. The broker maintains significant capital reserves exceeding $100 million, demonstrating strong financial stability.

Our key achievements include:

- Over 70 international awards

- More than 2 million registered clients worldwide

- Processing over 500 million orders annually

- Average execution speed of 11.06 milliseconds

South African traders can access our markets through various cutting-edge platforms with competitive trading conditions specifically tailored for the local market.

Regulatory Framework and Security

The security of traders’ funds and personal information remains our top priority. FxPro operates under strict regulatory oversight through multiple prestigious licenses.

Our current regulatory framework includes:

- Financial Sector Conduct Authority (FSCA) in South Africa – License 45052

- UK Financial Conduct Authority (FCA) – License 509956

- Cyprus Securities and Exchange Commission (CySEC) – License 078/07

- Securities Commission of The Bahamas (SCB) – License SIA-F184

We implement comprehensive security measures to protect our clients’ interests. All client funds are kept in segregated accounts with top-tier banks, ensuring complete separation from operational funds. Our security infrastructure includes advanced encryption protocols, negative balance protection, and regular external audits.

Trading Accounts Overview

FxPro offers several account types specifically designed for South African traders. Each account type provides unique features and trading conditions to accommodate different trading styles and experience levels.

Our Standard Account includes these key features:

- Minimum deposit: R1,500 (ZAR)

- Variable spreads from 1.4 pips

- No commission fees

- Maximum leverage 1:2000

For more experienced traders, we provide the Raw+ Account which delivers enhanced trading conditions. This account requires a higher initial investment but offers superior trading conditions including raw spreads and professional trading tools. The minimum deposit starts at R15,000 (ZAR), with raw spreads from 0.2 pips and a commission of $7 per lot round turn.

Trading Platforms and Tools

FxPro provides comprehensive trading solutions through multiple sophisticated platforms. Each platform is designed to meet specific trading needs and preferences.

MetaTrader 4 (MT4) platform features:

- Classic intuitive interface

- Advanced charting tools and indicators

- Expert Advisors support

- Mobile trading capability

- Custom indicators and scripts

The MetaTrader 5 (MT5) platform offers enhanced capabilities including:

- Modern interface with improved functionality

- Enhanced analytical tools

- Multiple asset classes

- Advanced order types

- Integrated economic calendar

Deposits and Withdrawals

We offer various convenient payment methods for South African traders, ensuring smooth and secure financial operations.

Available payment methods include:

- Local bank transfers (ZAR)

- Credit/Debit cards (Visa/MasterCard)

- Electronic wallets (Neteller, Skrill)

- Cryptocurrency transfers

Processing times vary by method:

- Deposits: Instant to 24 hours

- Withdrawals: 1-5 business days

- No processing fees from FxPro

- Minimum withdrawal: R300

Trading Instruments and Markets

Our extensive range of trading instruments caters to diverse trading strategies. Below is a detailed breakdown of our offerings: Trading Instruments Table:| Instrument Type | Number of Assets | Spreads From | Trading Hours |

| Forex Pairs | 70+ | 1.0 pips | 24/5 |

| Stock CFDs | 2000+ | 0.1% | Market hours |

| Indices | 18 | 0.5 points | Extended |

| Commodities | 12 | 0.3 points | Various |

| Cryptocurrencies | 28 | 0.5% | 24/7 |

Educational Resources

FxPro maintains a comprehensive educational ecosystem supporting traders at all skill levels. Our educational hub includes regularly updated materials and tools designed to enhance trading knowledge and skills.

Available resources include:

- Trading courses (beginner to advanced)

- Daily market analysis and research

- Live trading webinars

- Economic calendar

- Video tutorials

- Trading guides and articles

Our commitment to trader education extends to providing local market insights specifically relevant to South African traders.

Trading Features and Conditions

FxPro provides exceptional trading conditions designed to enhance the trading experience. Our commitment to transparency and fair trading practices sets industry standards.

Key trading features include:

- No dealing desk execution

- Ultra-low latency

- Deep liquidity pools

- Competitive swap rates

- Multiple order types

We maintain relationships with top-tier liquidity providers, ensuring best execution practices and minimal slippage. The average order execution time stands at 11.06 milliseconds, with the capability to process over 7,000 orders per second during peak market conditions.

Client Testimonials

Real traders share their experiences with FxPro, highlighting various aspects of our services:

David M., Cape Town: “Trading with FxPro for three years has proven consistently reliable. Their execution speed remains impressive, and their support team maintains professional standards throughout all interactions.”

Sarah K., Johannesburg: “The educational resources helped me build a solid foundation in forex trading. I particularly value their platform stability and diverse range of trading instruments.”

Michael R., Durban: “What stands out about FxPro is their transparent approach to trading. Withdrawals process smoothly, spreads remain competitive, and technical support responds promptly to any queries.”

Frequently Asked Questions

The minimum deposit varies by account type: R1,500 for Standard accounts, R15,000 for Raw+ accounts, and R450,000 for Elite accounts. All deposits can be made in ZAR.

Client funds are held in segregated accounts at tier-1 banks, protected by negative balance protection, and overseen by multiple regulatory authorities including the FSCA.

Forex trading is available 24/5, stock CFDs follow market hours, indices have extended hours, and cryptocurrencies can be traded 24/7. Specific trading hours for each instrument are available on our trading platform.