FxPro Forex Ratings

FxPro: An Overview

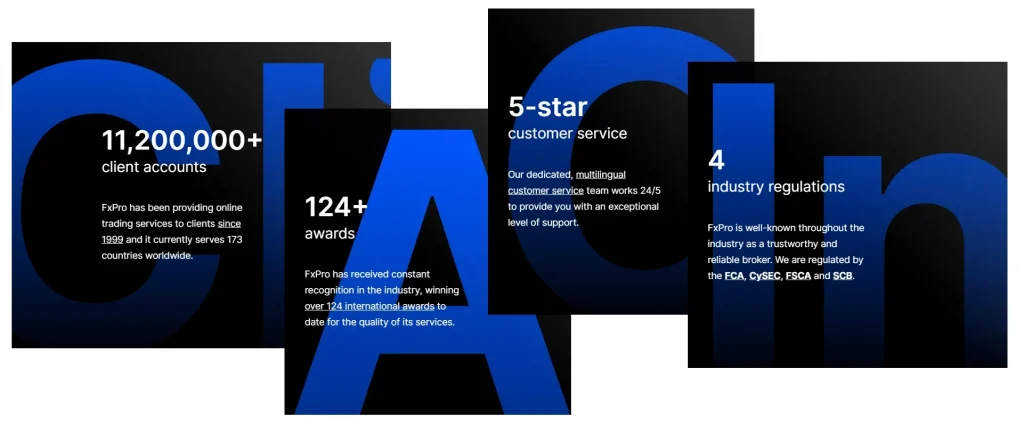

FxPro broker, established in 2006, has become a prominent player in the forex industry. With its headquarters in London and offices worldwide, the broker has expanded its services to over 170 countries, including South Africa. FxPro’s commitment to providing a secure and efficient trading environment has contributed to its growing popularity among South African traders.Regulatory Compliance and Security

One of the primary factors contributing to FxPro’s positive forex ratings is its strong regulatory framework. The broker is regulated by multiple tier-1 authorities, including:- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA) in South Africa

Trading Platforms and Tools

FxPro offers a diverse range of trading platforms, catering to different trader preferences and experience levels. The available platforms include:| Platform | Features | Suitable for |

| MetaTrader 4 | Classic interface, extensive indicators | Beginners and experienced traders |

| MetaTrader 5 | Advanced charting, multi-asset trading | Professional traders |

| cTrader | Customizable interface, level II pricing | Scalpers and algorithmic traders |

| FxPro Edge | Proprietary platform, user-friendly design | All trader levels |

Account Types and Trading Conditions

FxPro offers several account types to accommodate different trading styles and preferences:- Standard Account

- Raw Spread Account

- Zero Spread Account

- Variable Spread Account

| Feature | Standard Account | Raw Spread Account | Zero Spread Account |

| Minimum Deposit | $100 | $500 | $1000 |

| Spreads | From 1.2 pips | From 0.1 pips | 0 pips |

| Commission | No | Yes | Yes |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

FxPro Broker Review: Trading Instruments

As a multi-asset broker, FxPro offers a wide range of trading instruments, including:- Forex pairs (major, minor, and exotic)

- Cryptocurrencies

- Stocks and indices

- Commodities

- Futures

Spreads and Fees

FxPro’s competitive pricing structure contributes significantly to its positive forex ratings. The broker offers tight spreads across its account types, with Raw Spread accounts featuring spreads as low as 0.1 pips on major currency pairs. While some accounts charge commissions, the overall cost of trading remains competitive compared to other brokers in the South African market.

Education and Research

FxPro demonstrates a strong commitment to trader education, offering a comprehensive suite of learning resources. These include detailed trading guides, informative video tutorials, and regular webinars and seminars. The broker also provides valuable tools such as an economic calendar and in-depth market analysis. This extensive educational offering is particularly beneficial for novice South African traders looking to enhance their trading knowledge and skills, providing them with the necessary foundation to navigate the complex forex market confidently.

Customer Support

FxPro’s customer support is available 24/5, catering to the needs of South African traders across different time zones. Support channels include:

- Live chat

- Phone support

- FAQ section

The broker’s multilingual support team ensures effective communication with traders from diverse backgrounds.

FxPro Broker Review: User Testimonials

To provide a balanced perspective, let’s examine some user testimonials from South African traders:

- John M., Johannesburg: “I’ve been using FxPro for two years now, and I’m impressed with their execution speed and tight spreads. The MT4 platform works flawlessly, and their customer support is always helpful.”

- Sarah K., Cape Town: “As a beginner trader, I found FxPro’s educational resources extremely valuable. The demo account helped me practice without risking real money. However, I wish they offered more localized content for South African traders.”

- David R., Durban: “FxPro’s regulatory compliance gives me peace of mind. I appreciate their transparent fee structure and diverse range of trading instruments. The only drawback is the lack of a local office in South Africa.”

Conclusion

In conclusion, FxPro forex ratings in South Africa are generally positive, reflecting the broker’s strong regulatory framework, diverse platform offerings, and competitive trading conditions. The broker’s multi-asset portfolio, educational resources, and reliable customer support contribute to its appeal among South African traders.

However, like any financial service provider, FxPro has areas for improvement. Some users have expressed a desire for more localized content and a physical presence in South Africa. Despite these minor drawbacks, FxPro remains a solid choice for South African traders seeking a reputable and well-rounded forex broker.

Frequently Asked Questions

Yes, FxPro is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring compliance with local financial regulations.

The minimum deposit varies depending on the account type. Standard accounts can be opened with as little as $100, while other account types may require higher initial deposits.

Yes, FxPro provides negative balance protection to all its retail clients, including those in South Africa, ensuring that traders cannot lose more than their account balance.