Leverage FxPro

Leverage Overview

FxPro provides South African traders with flexible leverage options up to 1:2000. The available leverage ratios vary depending on the trading instrument and account type. Leverage allows traders to control larger positions with smaller capital requirements.

Our leverage system maintains regulatory compliance while offering competitive trading conditions. Different instruments carry specific leverage limitations based on market volatility and risk factors. The system includes automatic margin monitoring and protection mechanisms.

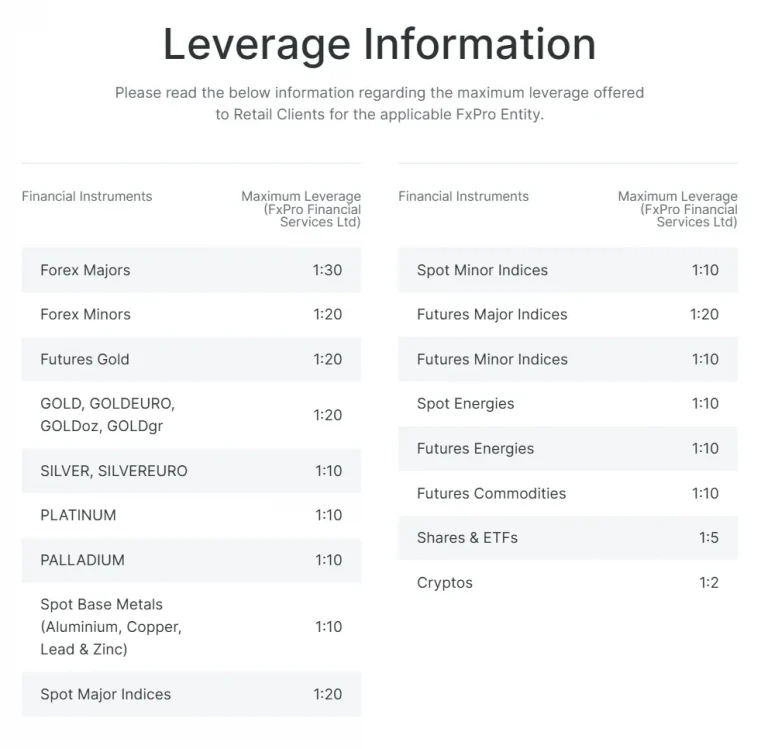

Maximum Leverage Table

Available leverage by instrument type:| Instrument | Maximum Leverage | Margin Requirement |

| Major Forex | 1:2000 | 0.05% |

| Minor Forex | 1:1000 | 0.1% |

| Stocks | 1:20 | 5% |

| Indices | 1:200 | 0.5% |

| Crypto | 1:5 | 20% |

Forex Leverage Options

Forex trading offers the highest leverage ratios in our system. Major currency pairs allow leverage up to 1:2000, while minor pairs maintain different ratios. The forex leverage system includes automatic adjustment based on position size.

Trading conditions remain consistent across all platforms with applied leverage. Position sizes affect available leverage ratios through tiered systems. Margin requirements increase proportionally with position size.

Currency Pair Categories

Leverage ratios for different currency categories:

- Major pairs: Up to 1:2000

- Minor pairs: Up to 1:1000

- Exotic pairs: Up to 1:500

- Emerging market pairs: Up to 1:200

Stock CFD Leverage

Stock CFD trading maintains specific leverage limitations. The maximum leverage for stocks reaches 1:20, reflecting market conditions. Position sizes affect available leverage ratios for stock trading.

Stock leverage includes automatic adjustment systems based on market volatility. Different stock categories maintain varying leverage ratios. Market conditions may affect available leverage options.

Stock Market Categories

Different markets maintain specific leverage requirements:

- US stocks: Up to 1:20

- European stocks: Up to 1:10

- Asian stocks: Up to 1:10

- Local stocks: Up to 1:15

Index Trading Leverage

Index trading provides leverage options up to 1:200. Different indices maintain specific leverage limitations based on market conditions. The system includes automatic leverage adjustment during market events.

Index leverage remains consistent across trading sessions. Position sizes affect available leverage options. Market volatility may impact leverage availability.

Cryptocurrency Leverage

Cryptocurrency trading maintains conservative leverage ratios. Maximum leverage for crypto reaches 1:5, reflecting market volatility. The system includes specific protection mechanisms for crypto trading. Crypto leverage includes automatic adjustment based on market conditions. Different cryptocurrencies maintain varying leverage ratios. Position sizes affect available leverage options.

Margin Requirements

Margin requirements vary by instrument and leverage ratio. The system calculates required margin automatically based on position size. Margin calls trigger at specific levels to protect trading accounts.

Margin Level Monitoring

The margin monitoring system includes:

- Real-time margin level calculation

- Automatic notification system

- Margin call warnings

- Stop-out protection

Risk Management Tools

FxPro provides comprehensive risk management tools for leveraged trading. These tools help monitor and control trading exposure. The system includes automatic protection mechanisms.

Available risk management features:

- Position size calculator

- Margin calculator

- Risk assessment tools

- Exposure monitoring

Protection Mechanisms

Account protection includes multiple safety features for leveraged trading. The system maintains automatic monitoring and adjustment capabilities. Protection mechanisms activate at specific trigger points.

Negative Balance Protection

Protection features include:

- Automatic margin monitoring

- Stop-out levels

- Position closing system

- Balance protection

Leverage Adjustment System

The leverage adjustment system operates automatically based on market conditions. Position sizes affect available leverage options. The system includes protection mechanisms during high volatility periods.

Dynamic Leverage Rules

Dynamic leverage adjustments occur based on:

- Market volatility

- Position size

- Account equity

- Instrument type

Frequently Asked Questions

Leverage allows control of larger positions with smaller capital. For example, 1:100 leverage means R1,000 can control a R100,000 position, increasing both potential profits and risks.

No, leverage levels remain fixed for open positions. New positions will reflect current leverage settings and market conditions.

The system sends warnings when margin levels approach critical levels. If margin requirements are not met, positions may be automatically closed to protect account balance.