FxPro Withdrawal

FxPro Withdrawal: A Comprehensive Guide for South African Traders

In the world of forex trading, the ability to efficiently withdraw funds is as crucial as making profitable trades. For South African traders using FxPro, understanding the withdrawal process is essential for managing their trading accounts effectively. This article provides an in-depth look at FxPro withdrawal procedures, focusing on the experience of South African traders.Overview of FxPro in South Africa

FxPro, a globally recognized forex broker, has been serving South African traders since its establishment in 2006. The broker’s presence in the country is marked by its regulation under the Financial Sector Conduct Authority (FSCA), ensuring compliance with local financial regulations. This regulatory oversight provides a layer of security for South African traders when it comes to fund withdrawals.FxPro Withdrawal Methods for South African Traders

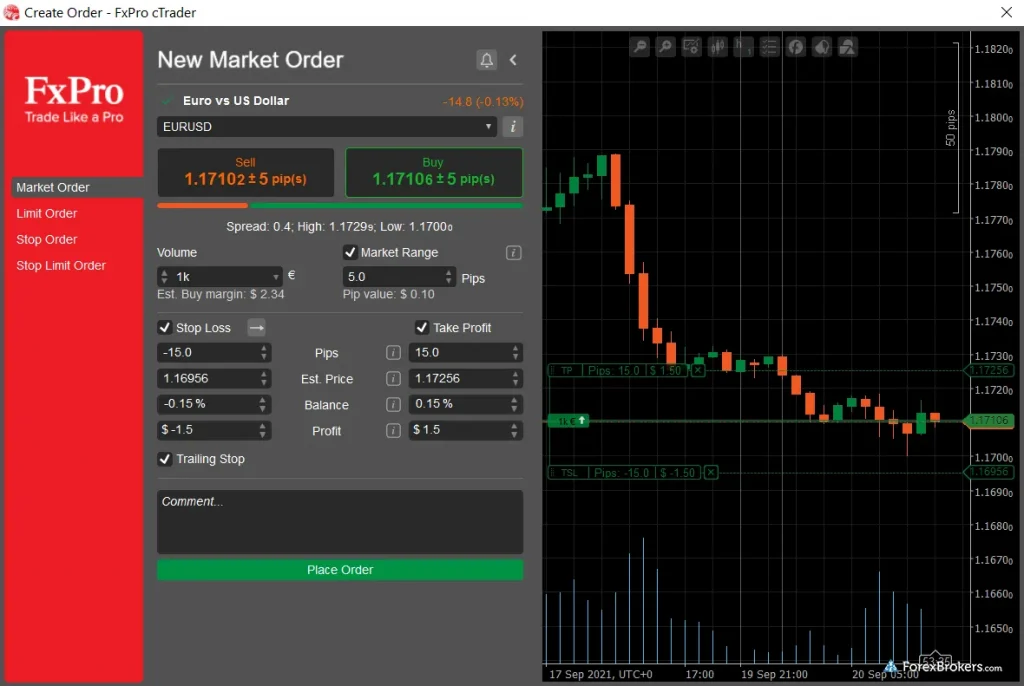

FxPro offers several withdrawal methods to cater to the diverse needs of South African traders. These methods include:- Bank Wire Transfer

- Credit/Debit Cards

- E-wallets (Skrill, Neteller)

- FxPro Card

| Method | Processing Time | Fees | Minimum Withdrawal |

| Bank Wire | 2-5 business days | Varies | $100 |

| Credit/Debit Cards | 1-3 business days | Free | $50 |

| E-wallets | 24 hours | Free | $50 |

| FxPro Card | Instant | Varies | $10 |

How Long Does FxPro Withdrawal Take?

The FxPro withdrawal time can vary depending on the chosen method. While e-wallet withdrawals are typically processed within 24 hours, bank wire transfers may take 2-5 business days. Credit/debit card withdrawals usually fall in between, with processing times of 1-3 business days.

It’s important to note that these are average processing times, and actual FxPro withdrawal time may be affected by various factors such as:

- Verification status of the account

- Time of request (during business hours or weekends)

- Bank processing times (for wire transfers)

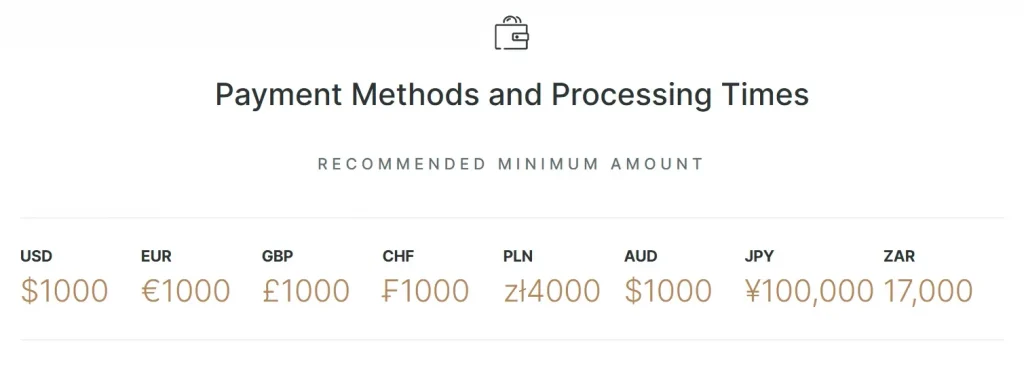

FxPro Minimum Withdrawal: What South African Traders Should Know

Understanding the FxPro minimum withdrawal requirements is crucial for effective account management. The minimum withdrawal amount varies depending on the method used:

- Bank Wire Transfer: $100

- Credit/Debit Cards: $50

- E-wallets: $50

- FxPro Card: $10

These FxPro minimum withdrawal limits are designed to balance the costs associated with processing withdrawals while providing flexibility to traders.

Table 2: FxPro Minimum Withdrawal by Method

Withdrawal Method | Minimum Amount |

Bank Wire Transfer | $100 |

Credit/Debit Cards | $50 |

E-wallets | $50 |

FxPro Card | $10 |

FxPro Withdrawal Review: The South African Experience

Based on user feedback and FxPro withdrawal reviews from South African traders, the overall experience has been generally positive. Many users appreciate the variety of withdrawal options and the relatively quick processing times, especially for e-wallet withdrawals.

Positive aspects frequently mentioned in FxPro withdrawal reviews include:

- Transparent fee structure

- Reliable processing times

- Responsive customer support for withdrawal queries

However, some users have reported occasional FxPro withdrawal problems, which we’ll address in the next section.

Common FxPro Withdrawal Problems and Solutions

While FxPro strives to provide a smooth withdrawal process, some users have reported issues. Here are some common FxPro withdrawal problems and their potential solutions:

1. Verification Delays

Problem: Withdrawals held up due to incomplete account verification.

Solution: Ensure all required documents are submitted promptly and accurately.

2. Minimum Withdrawal Not Met

Problem: Unable to withdraw due to insufficient account balance.

Solution: Check the minimum withdrawal requirements for your chosen method.

3. Bank Transfer Delays

Problem: Longer than expected processing times for bank wire transfers.

Solution: Consider using e-wallets for faster processing times.

Table 3: FxPro Withdrawal Problems and Solutions

Problem | Solution |

Verification Delays | Submit all required documents accurately |

Minimum Withdrawal Not Met | Check minimum requirements for chosen method |

Bank Transfer Delays | Consider using e-wallets for faster processing |

Tips for Smooth FxPro Withdrawals

To ensure a hassle-free FxPro withdrawal experience, South African traders can follow these tips:

- Verify your account early: Complete the verification process as soon as possible to avoid delays when you’re ready to withdraw.

- Choose the right withdrawal method: Consider factors like processing time and fees when selecting your withdrawal method.

- Be aware of cut-off times: Submit withdrawal requests before the daily cut-off time to ensure same-day processing.

- Keep withdrawal limits in mind: Ensure your withdrawal amount meets the minimum requirements for your chosen method.

Monitor your account: Regularly check your account for any notifications or requests from FxPro regarding your withdrawal.

FxPro Withdrawal Fees: What South African Traders Should Expect

While FxPro doesn’t charge fees for most withdrawal methods, there may be some associated costs depending on the chosen method:

Table 4: FxPro Withdrawal Fees

Method | FxPro Fee | Third-Party Fees |

Bank Wire | Free | Possible intermediary bank fees |

Credit/Debit Cards | Free | None |

E-wallets | Free | Possible e-wallet fees |

FxPro Card | Free for first withdrawal per month | $10 for subsequent withdrawals |

Comparing FxPro Withdrawal to Other Brokers

When evaluating FxPro’s withdrawal process against other brokers serving South African traders, several factors stand out positively. These include a diverse range of withdrawal methods, competitive processing times, reasonable minimum withdrawal amounts, and a transparent fee structure. While FxPro’s offerings are generally competitive in the market, it’s important for traders to conduct thorough comparisons across multiple brokers. This approach ensures that they find the broker that best aligns with their individual trading needs and preferences, particularly in terms of fund withdrawal efficiency and flexibility.

Conclusion

In conclusion, the FxPro withdrawal process for South African traders is characterized by a range of options, reasonable processing times, and generally positive user experiences. The broker’s commitment to transparency and regulatory compliance provides a secure environment for fund withdrawals.

However, like any financial service, there can be occasional challenges. By understanding the FxPro withdrawal time, minimum withdrawal requirements, and potential issues, South African traders can better navigate the withdrawal process and manage their trading accounts effectively.

Frequently Asked Questions

FxPro withdrawal time varies depending on the method chosen. E-wallet withdrawals are usually processed within 24 hours, credit/debit card withdrawals take 1-3 business days, and bank wire transfers can take 2-5 business days.

The FxPro minimum withdrawal amount varies by method. For bank wire transfers, it’s 100,forcredit/debitcardsande−wallets,it′s100, for credit/debit cards and e-wallets, it’s 100,forcredit/debitcardsande−wallets,it′s50, and for the FxPro Card, it’s $10.

If you encounter FxPro withdrawal problems, first ensure your account is fully verified and you’ve met the minimum withdrawal requirements. If issues persist, contact FxPro’s customer support for assistance. They’re available 24/5 to help resolve any withdrawal-related concerns.